what percent of tax is taken out of paycheck in nj

Tax brackets vary based on filing status and income. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare.

Why Households Need 300 000 To Live A Middle Class Lifestyle

Some deductions from your paycheck are made.

. New Jersey has a progressive income tax policy with rates that go all the way up to 1075 for gross income over 5 million. The average amount taken out is 15 or more for. The amount of money you actually take home after tax.

The percentage of taxes taken out of a paycheck depends on the number of exemptions you are allowed to claim. However they dont include all taxes related to payroll. The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially.

Amount taken out of an average biweekly paycheck. You can have 10 in federal taxes withheld directly from your pension and. How Much Money Gets Taken Out of Your Paycheck.

The total bill would be about 6800 about 14 of your taxable income even though youre in the 22 bracket. This is applied only to the first 7000 in earnings an employee makes in every tax year. Amount taken out of an average biweekly.

This tax is not shared it is paid only by the employer. New Jersey State Payroll Taxes. Both employers and employees are responsible for payroll taxes.

FICA taxes consist of Social Security and Medicare taxes. If you have a specific pay period amount of pay and W4 information for me I can tell you. I am receiving my pension from a company I worked for for 8 years in the.

Amount taken out of an average biweekly paycheck. Do Sole Proprietors Pay. Money may also be deducted or subtracted from a paycheck to pay for retirement or health benefits.

FICA taxes are commonly called the payroll tax. 1180 satisfied customers. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for New Jersey residents only.

Lets say you got a new job that pays 20hour. Withholding also depends upon what is on your W4. Where Do Americans Get Their.

That is a 10 rate. It is not a substitute for the. Payroll taxes and income tax.

How much state tax will come out of a 552733 pension pay out. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4. That 14 is called your effective tax rate.

New Jersey Salary Paycheck Calculator. Thats the deal only for federal. Dear There is no set percentage for NJ state withholding it works like Federal withholding---meaning that there are withholding formulas and generally the more money earned in a pay period the higher the percentage is taken out.

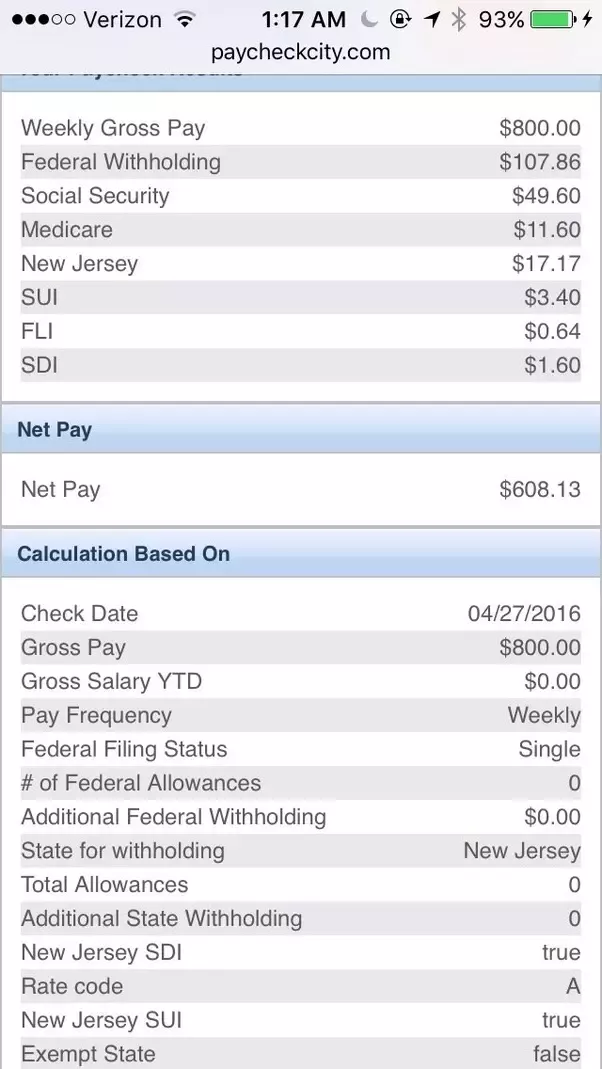

You fill out a pretend tax return and calculate that you will owe 5000 in taxes. Total income taxes paid. That works out to 800 per week 3200 per month and 41600 per year-.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Tax Withholding For Pensions And Social Security Sensible Money

Paycheck Taxes Federal State Local Withholding H R Block

Why Households Need 300 000 To Live A Middle Class Lifestyle

2021 New Jersey Payroll Tax Rates Abacus Payroll

Understanding Your Paycheck Credit Com

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

I Make 800 A Week How Much Will That Be After Taxes Quora

I Make 800 A Week How Much Will That Be After Taxes Quora

2020 New Jersey Payroll Tax Rates Abacus Payroll

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

New Jersey Nj Tax Rate H R Block

How Do State And Local Individual Income Taxes Work Tax Policy Center

New Jersey Residents Projected To Pay The Most State Taxes Over Their Lifetimes Don T Mess With Taxes

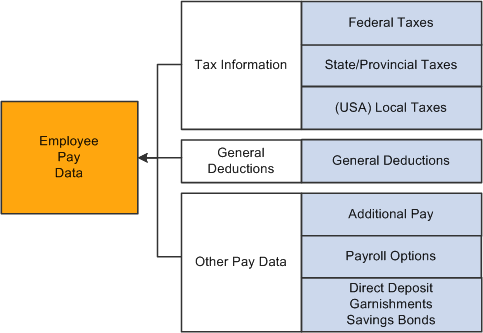

Peoplesoft Payroll For North America 9 1 Peoplebook

Anatomy Of A Paycheck What To Deduct And Why

New Tax Law Take Home Pay Calculator For 75 000 Salary