free cash flow yield private equity

To break it down free cash flow yield is determined first by using a companys. Free Cash Flow Yield.

Fcf Yield Unlevered Vs Levered Formula And Calculator

Like typical private equity funds such funds are usually structured as Limited Partnerships.

. People sometimes describe this as free cash flow yield Cash on Cash Yield is a different measurement often used to. Net Free Cash Flow NFCF Free Cash Flow FCF current portion of long term debt current portion of future dividends 1 year. Tailored portfolio solutions to institutional investing with 150 years of expertise.

Aflac Incorporated has a low debt total debt to equity is only 034 and it has a very low trailing PE of 1009 and a very low forward PE of 1034. Thats the ratio of free cash flow to market cap. I dont find Net Free Cash Flow used too much possibly.

Investments that offer stable cash flow are typically preferable as they entail less risk and offer the opportunity to put capital to work elsewhere sooner. Equity free cash-flow yield Equity free cash-flow is the cash generated each year for shareholders after certain non-discretionary expenses have been paid. By Analyst 2 in IB - Ind.

Free Cash Flow and. What is Leveraged Finance. Why Private Equity.

LFCF yield is calculated as levered free cash flow divided by the value of equity. Where FCFE 0 FCFE 1 FCFE 2 and FCFE n represent for the free cash flow to equity last year first year second year and nth year g is the growth rate k e is the cost of. Using that example your Cash Yield is 10.

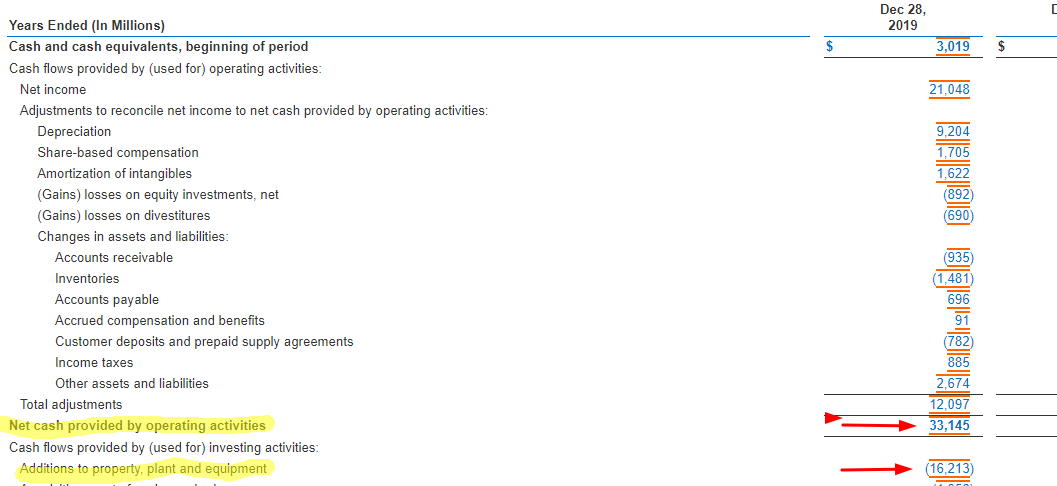

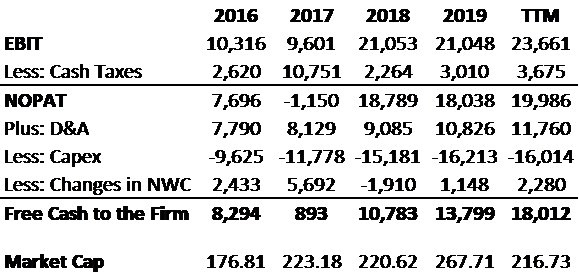

The trailing FCF yield for the SP 500 rose from 11 at the end of 2020 to 16 as of 51921 the earliest date 2021 Q1 data was provided by all SP 500 companies. Free Cash Flow is the cash available to distribute to stakeholders debt and equity holders after the bills are paid and after provisions have been made for the future of the. Since FCFE is intended to reflect the cash flows that go only to equity holders there is no need to add back.

Suppose you bought a property and your net cash flow was 5000 and the cash invested in your property was 50000. A Note on Using Cash. Free cash flow to the firm FCFF and free cash flow to equity FCFE are the cash flows available to respectively all of the investors in the company and to common stockholders.

The price to free cash flow. Free cash flow yield is meant to show investors how much free cash flow a company generates relative to the. The fund manager called General Partner collects money from investors the Limited Partners.

The free cash flow yield is an overall return evaluation ratio of a stock which standardizes the free cash flow per share a company is expected to earn. In corporate finance free cash flow to equity FCFE is a metric of how much cash can be distributed to the equity shareholders of the company as dividends or stock buybacksafter all. It had capex spending of 136 million which means CVR generates.

Ad See how we can create a proactive institutional investment approach for you. In the 12 months ending September CVR Energy produced Cash Flow from Operations of 747 million. Free cash flow yield is really just the companys free cash flow divided by its market value.

FCFE Net Income DA Change in NWC CapEx Net Borrowing.

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

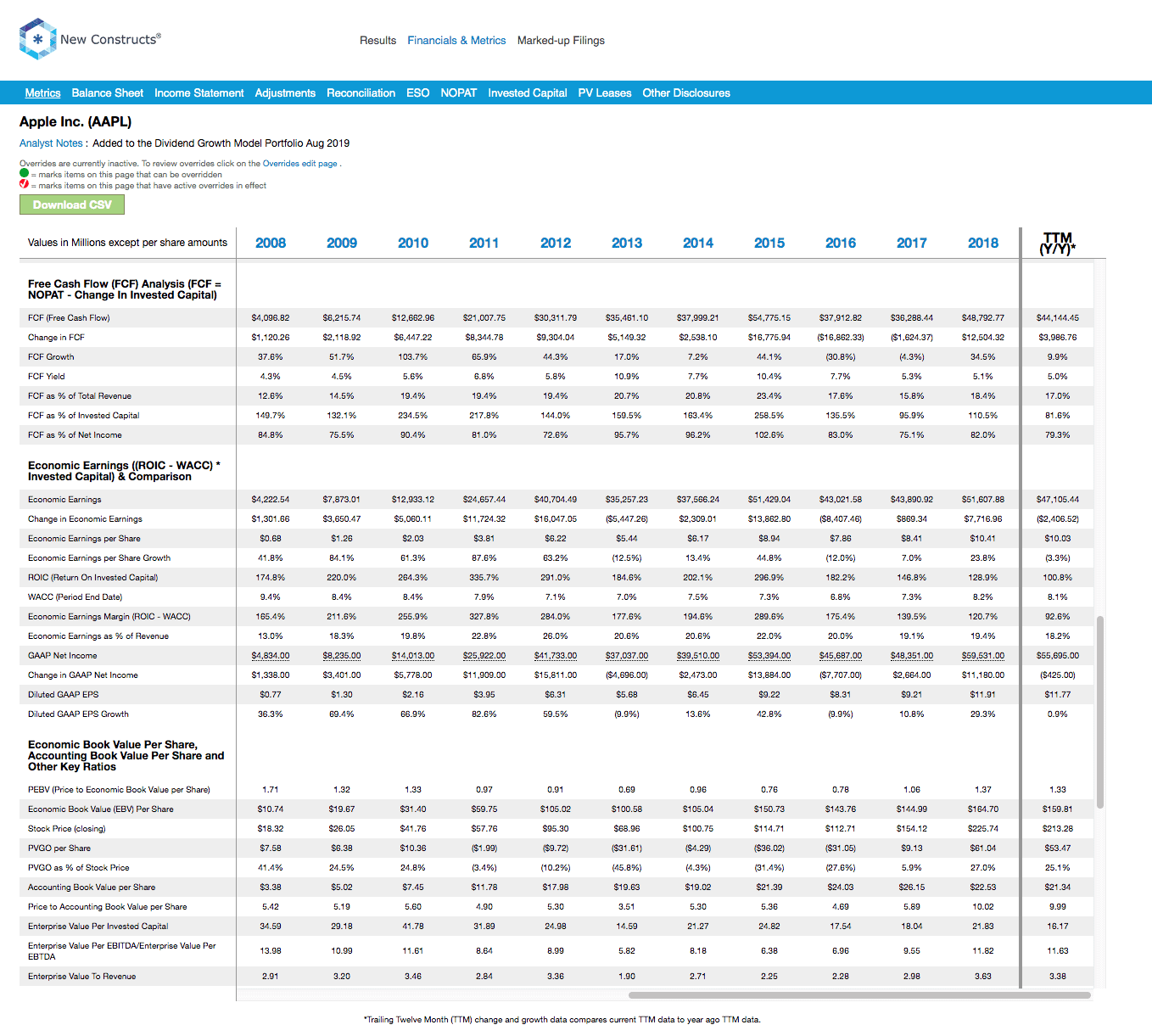

Education Metrics Fcf New Constructs

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Free Cash Flow Yield Explained

Free Cash Flow Fcf Most Important Metric In Finance Valuation

Education Metrics Fcf New Constructs

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)